SEC Climate Disclosure Rule: What You Need to Know

The U.S. Securities and Exchange Commission has adopted its long-awaited, final climate disclosure rule, with a few concessions to those who noted it wouldn’t be easy to comply with what the SEC proposed back in 2022.

“It’s a firm call to action that we—and many of our customers—have been working to prepare for,” said Workiva CEO Julie Iskow. “Having the right tech will be critical for companies trying to navigate this evolving landscape.”

First takes on the SEC climate rule

Gaps remain between these new SEC disclosure requirements and the CSRD (Corporate Sustainability Reporting Directive) in the European Union. For one thing, the SEC isn’t requiring anyone to disclose Scope 3 emissions, which are related to a company’s value chain.

But make no mistake: It will be onerous for many teams to compile the required information, including material climate-related risks and their financial impacts, how the board and executives are managing those risks, and climate-related goals that are material to the business, operational results or financial health of the business.

Nevertheless, I’m sure companies are breathing a sigh of relief that in addition to not requiring the measurement and disclosure of Scope 3 emissions, the SEC is giving companies time before the rule takes effect. It also has relaxed the annual deadlines for larger public companies to disclose Scope 1 and 2 emissions—if material. For foreign private issuers, that information will be due no later than 225 days after the end of the fiscal year. Only the largest companies will eventually need to obtain reasonable assurance of emissions disclosures.

Supporters of the SEC’s climate disclosure rule are counting on it to help standardise the release of information that investors, ratings agencies, regulators in other continents, and some customers and employees are already demanding. SEC Chair Gary Gensler noted that, until now, such information was generally posted on company websites rather than in SEC filings, which are inherently investor-grade.

While opponents have pledged lawsuits challenging the rule, I think it’d be highly risky for companies to sit back and hope this rule gets walked back or erased by courts or new political leaders.

Beyond compliance with regulation, there may be a business advantage for companies that have embedded sustainability factors into their corporate strategy and can implement assured integrated reporting—in other words, integrating sustainability with financial reporting and third-party assurance of the data. According to a recent survey, 88% of institutional investors surveyed say they’re more likely to invest in companies that obtain assurance of ESG data.

SEC climate rule resources

But back to the SEC’s climate disclosure rule. The SEC has published handy links to more information:

- Fact sheet, with a nice summary

- News release

- Final rule

Let’s quickly look at highlights of the SEC’s mandate before jumping into what I’d suggest companies do to comply with this 886-page rule, without tiring your SEC or ESG reporting teams.

SEC climate disclosure timeline

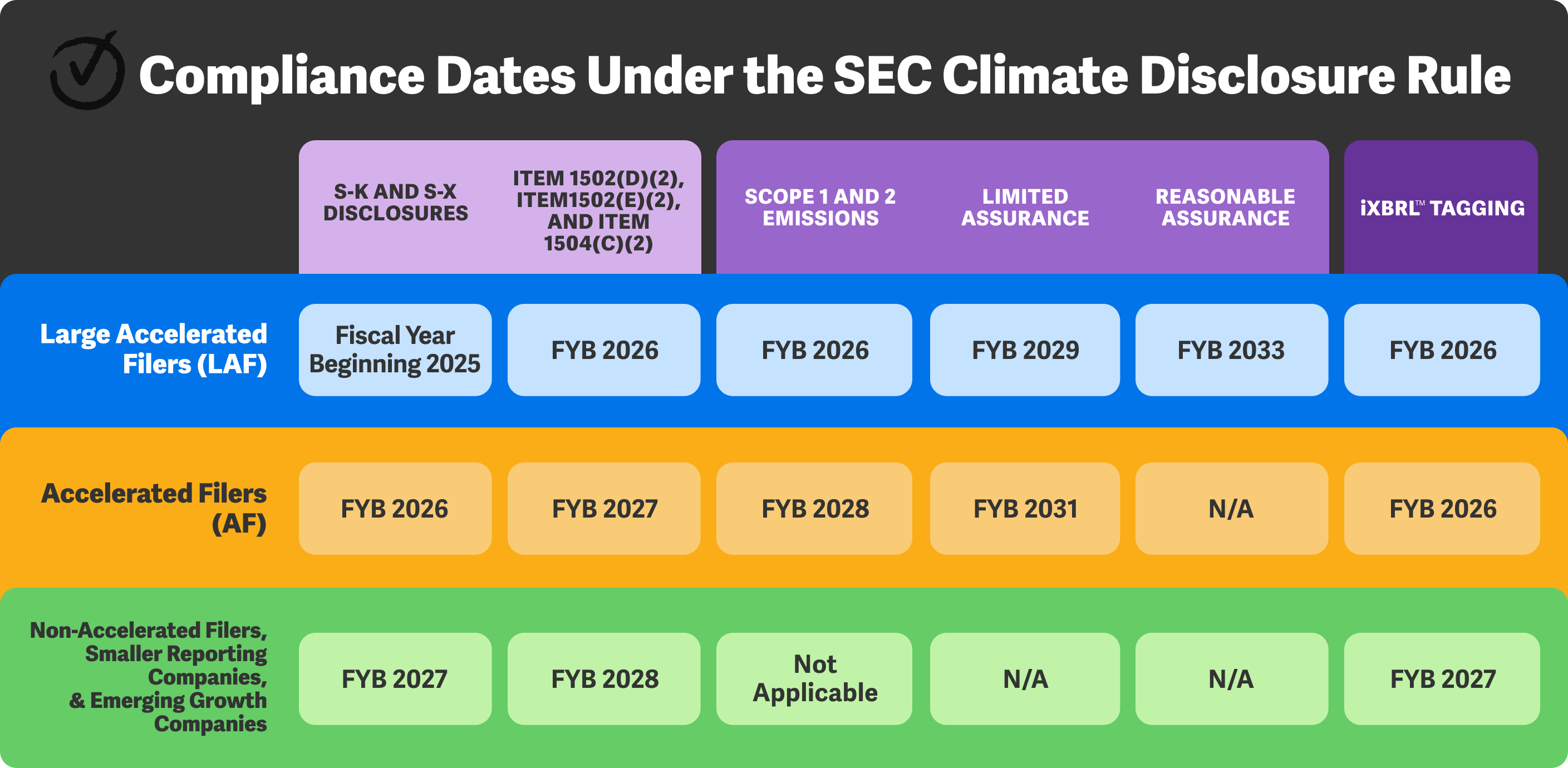

The SEC climate disclosure rule takes effect in phases. Here is a look at effective dates for large accelerated filers, accelerated filers and non-accelerated filers, as well as a smaller reporting company (SRC) or emerging growth company (EGC):

SEC climate disclosure rule requirements

See the SEC rule itself for full details, but at a high level, here’s what stands out to me:

- Materiality is a key principle. Companies must disclose climate-related risks that could likely have a material impact on corporate strategy, results of operations or financial condition—plus the potential material impacts of those risks, material expenditures to strategically mitigate risks, and material impacts on financial estimates and assumptions due to mitigation activities. That would include transition plans, scenario analysis and internal carbon prices (and there’s a safe harbor provision for that). Climate-related goals that have material impacts need to be disclosed.

- The SEC wants to give investors a window into how company leaders are thinking. How are your board of directors and management identifying, assessing and managing material climate-related risks, including how that fits in overall risk management?

- That pesky 1 percent threshold is still a thing for weather events. Material impacts of natural disasters or extreme weather must be disclosed in a note to the financial statements, with narrow exceptions for low-dollar impacts. See the full rule for more on calculations.

- Carbon offsets and credits are getting attention. In a financial statement footnote, disclose financial impacts of carbon offsets and renewable energy credits or certificates (RECs) if they’re material to meeting your goals.

- Be ready for iXBRLTM tagging. Companies would need to add XBRL® tagging to climate-related disclosures and present them in iXBRL format, just as they do for financial data, so they can be read by both machines and humans.

The SEC modeled its climate disclosure framework partly on recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), now a part of the International Sustainability Standards Board (ISSB), plus the Greenhouse Gas Protocol.

Top takeaways for the SEC climate disclosure rule

These would be some of my takeaways for SEC reporting teams and ESG practitioners:

- Assurance of data is here. The addition of climate-related data to the financial statements are notable and will be subject to internal controls over financial reporting (ICFR), which get audited by both management and external auditors.

- So is collaboration across teams. The SEC will expect consistency across financial statement footnotes, management discussion and analysis (MD&A) in the annual report and sustainability reports. Companies will need to engage their internal audit teams to implement robust controls that govern data related to climate metrics, models and assumptions that will affect financial statements and other disclosures to the SEC.

- Speaking of teams, assemble yours. A cross-functional team can help you identify which processes you’re already doing that you might not have thought of as ESG reporting processes. For example, perhaps you already have a department tracking GHG emissions as part of efforts to qualify for carbon-friendly tax incentives. The team can also identify gaps in reporting.

- How auditor-friendly is your reporting process and technology today? Reviewers will need visibility into how your data was sourced, prepared and reported to ensure consistency across the various places that climate metrics will be disclosed, both for SEC reporting and to other ESG reporting stakeholders.

- Technology could be your lifeline. It’s possible your company may now be compiling disclosures to comply with requirements by the European Union, California, the SEC and proposals in Asia, not to mention requests for information from customers and ESG raters and rankers. Integrated reporting software can help teams with limited resources accelerate how they compile, review and report data with accuracy, efficiency and consistency.

How to prepare for the new SEC climate rule

If you haven’t already, determine what it will take to comply with the SEC climate disclosure rule. Members of the SEC, ESG and SOX Professionals Groups have said they have been pulling together cross-functional teams regularly to discuss how to provide assured integrated reporting of financial and ESG data. In my view, that cross-functional team should probably look similar to your current disclosure committee with a few new faces. I’d suggest including members of your SEC reporting and legal teams, internal and external auditors, ESG teams, corporate communications and investor relations to get started.

Identify gaps in data collection and how you will gather, report and assure the data.

Technology can automate the more time-consuming aspects of the process, so you can comply without overburdening staff. Yet roughly two-thirds of executives surveyed say they’re concerned the business reporting technology their companies are using is insufficient for meeting new reporting requirements. Start evaluating and implementing ESG technology now so you can do a test run of how you will compile, report, review and assure financial and non-financial data for an annual report to the SEC.

You may be able to use technology you already have. For example, Workiva has seen some of our SEC reporting solution and iXBRL customers add our ESG, SOX compliance, and internal audit management solutions to build out their assured integrated reporting capabilities.

At a minimum, teams would benefit from having a connected hub uniting financial and non-financial reporting where SEC, ESG, legal, board reporting and audit teams can work together to keep executive ESG task force or board committee members informed. I’m talking about a digital headquarters, if you will, where they can all use the same source data, with complete visibility and control into multiple reporting processes, all with auditability and assurance.

Final thoughts on the SEC climate disclosure rule

Climate-related risks and opportunities, social responsibility and corporate governance are influencing valuations, customer decisions and where institutions are investing. Regardless of whether your disclosures include ESG factors for regulatory compliance or to tell your sustainability story, it’s in financial reporting teams’ hands to do so with assured integrated reporting.

Watch the Workiva calendar for upcoming events that dig into best practices for ESG disclosures. (Separately, the SEC, SOX and ESG Professionals Groups have chat boards where you can swap ideas with peers.)

See how you can use Workiva for assured integrated reporting and more. Request a demo.

XBRL and iXBRL are trademarks of XBRL International, Inc. All rights reserved. The XBRL™/® standards are open and freely licensed by way of the XBRL International License Agreement.

Executive Summary: A Snapshot of the SEC’s Climate Disclosure Rule

Review what’s ahead in ESG reporting requirements. Plus, discover five steps organizations can take now to be ready for it.